Electronics Sector Risk Report

Strengths & Weaknesses

Broad Customer Base

The sector serves a wide range of industries, including consumer electronics, automotive, and telecommunications.

Growth Fueled by Innovation

Digital transformation and advancements in AI are driving long-term expansion across the electronics landscape.

High Entry Barriers

Cutting-edge technology and complex production processes make it difficult for new players to enter, especially at the high end.

Tight Margins and Low Barriers

The commodity electronics market struggles with easy entry and narrow profit margins, leading to intense competition.

Market Saturation

Segments such as smartphones and computers are overcrowded, requiring major innovation and investment to grow.

Cyclical Demand

The industry is highly sensitive to economic cycles, experiencing frequent shifts in demand.

Electronics Sector Outlook

Emerging Trends and Market Drivers

The electronics industry is evolving rapidly amid global tensions, technological disruption, and changing consumer habits. With artificial intelligence and automation driving demand, and geopolitical pressures reshaping the semiconductor supply chain, the sector stands at a pivotal moment.

Despite recent challenges, 2024 is expected to bring renewed growth and investment, especially in high-tech domains like EVs and AI.

- US–China rivalry is intensifying the global semiconductor race.

- AI and Industry 4.0 are fueling demand for advanced electronic components.

- Consumer demand remains fragile due to reduced purchasing power.

- Semiconductor sales are projected to grow 10%+ in 2024, surpassing 2022 highs.

Strategic Challenges and Opportunities

The sector remains profitable, with strong margins and a commitment to innovation. However, global trade tensions and dependence on key players like China pose major risks.

Countries are responding with aggressive policy measures to boost domestic capabilities—offering new avenues for growth while introducing regional complexity.

- Semiconductor EBITDA margin was ~30% in 2023.

- Double-digit growth in revenue and earnings is expected over the next 5 years.

- US Chips Act and similar initiatives are driving local R&D and manufacturing.

- Geopolitical risks, especially US–China friction, threaten supply chains.

- Asia remains dominant, but the US and Europe are investing to reduce dependency. Ask ChatGPT

Subsectors in the Electronics Industry

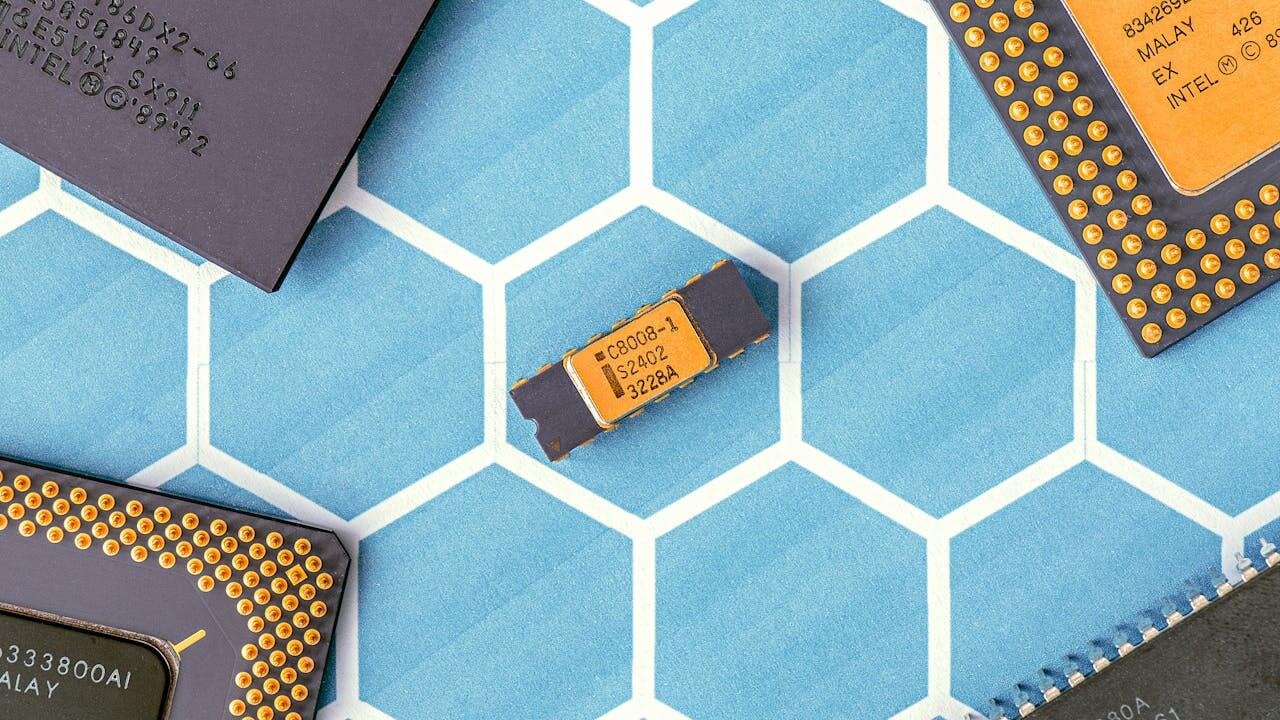

Electronic components can be broadly categorized into semiconductors and other active or passive components and subsystems. Semiconductors play a crucial role in various applications, including computing, storage, power management, and communication, making them integral to nearly all electronic devices.

The market for these products is typically concentrated, with a few major global companies leading the way. In contrast, the rest of the industry is much more diverse and often commoditized, featuring a wide range of manufacturers that produce items such as printed circuit boards, electronic displays, resistors, capacitors, and switches.